January 22, 2023

For more than a decade we have seen a rapid rise in asset values. Low-interest rates spurred borrowing amongst businesses and individuals. It remains uncertain how interest rates will continue to rise or taper off in the coming months. To put it simply, if rates continue to rise further, we can expect a significant drop in asset values.

Properties are not spared in this scenario. A recent survey in 2019 by the People’s Bank of China (PBoC) showed that housing accounted for almost 60% of household assets. This suggests that falling property prices would hit household wealth and consumption. Banks’ direct and indirect exposure to the property sector is estimated at more than 50% of their total loans, raising concerns about systemic risk should the property market crash.

In Singapore, policies such as the ABSD (Additional Buyer Stamp Duty) and TDSR (Total Debt Servicing Ratio) may be considered effective to curb demand and over-leveraging.

Mortgage pressures on personal finances are on the rise. With rising interest rates, owners are forking out more from their cashflow each month to finance the mortgage. This naturally reduces consumption in other areas. Low expenditure, a drop in sales and revenues, thus shrinking demand and confidence.

However, we may have forgotten a term that was prevalent in 2008 – Negative Equity Situation.

Negative equity in property refers to a situation where the value of a property is less than the outstanding amount of debt associated with that property. This can occur due to a variety of factors, including a decline in property values, an increase in interest rates, or a combination of both. Throughout history, negative equity has affected property markets across the world, with varying degrees of severity.

One of the examples of negative equity in recent history occurred during the Global Financial Crisis of 2008. The crisis was triggered by a collapse in the US housing market, which had been fuelled by risky lending practices and a bubble in housing prices. As housing prices began to decline, many property owners found themselves with properties that were worth less than the amount of debt they had taken on. This led to a sharp increase in foreclosures and a severe downturn in the global economy.

For example, if someone had bought a $2 million property recently, made a down payment of 25% and borrowed $1.5 million, they may be at risk. If the asset value becomes $1.4 million, due to a 30% drop in property values, then the asset is now worth less than the outstanding loan amount.

Many property owners back in 2008 who found themselves in this situation were unable to sell or refinance their properties. This led to a significant increase in foreclosures, which further depressed housing prices and created a vicious cycle of falling values and rising debt.

Similar patterns of negative equity situations emerged in other parts of the world during the global financial crisis. In the UK, for example, the decline in housing prices and a rise in interest rates led to a significant increase in negative equity cases, particularly in areas such as Northern Ireland and Scotland.

To avoid negative equity, it is important for property owners to take a hard look at their mortgages and stress-testing their ability to finance the loans. Negative equity in property has been a recurrent issue throughout history, and it can have severe consequences for property owners, the economy and the society as a whole. It is important to be aware of the risks, and be cautious when taking on large amounts of debt, especially during times of economic uncertainty.

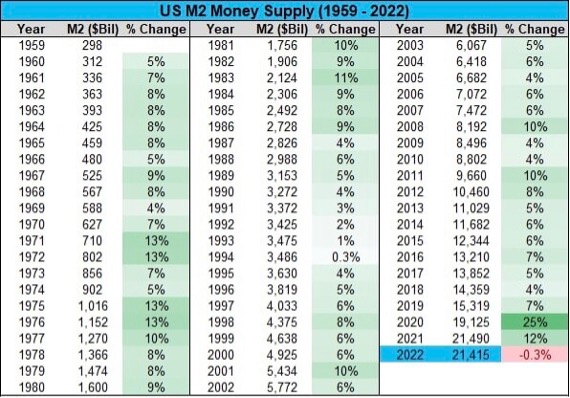

We are battling on two fronts, at least. A rise in interest rates, and a dearth of money supply.