The Supplementary Retirement Scheme (SRS) was established on 1st April 2001, to complement our Central Provident Fund (CPF) savings. While our CPF savings are often used for housing, education and medical payments, SRS is a tax-incentivised, voluntary form of savings strictly meant for retirement.

SRS is open to all Singaporeans, Singapore Permanent Residents (SPRs) and foreigners, who are at least 18 years of age, and not undischarged bankrupts or of unsound mind.

We can choose to stop the SRS contribution or make a withdrawal from the SRS Account anytime. However, the intention of SRS is for long term savings and a penalty is in place to discourage premature withdrawal from our SRS account. If you withdraw from your SRS account before the prevailing statutory retirement age, 100% of the withdrawal amount is taxable and there will be a penalty of 5%. If the withdrawal from our SRS account is on or after the prevailing statutory retirement age, only 50% of the amount drawn will be subject to tax. We can also spread your withdrawals over a period of up to 10 years, to meet your financial needs. Spreading out your withdrawals will generally result in greater tax savings.

An SRS account must first be opened with an approved bank. Every dollar that is voluntarily contributed in cash will result in the same amount of tax relief. The maximum SRS contribution is $15,300 a year for a Singaporean or Singapore Permanent Resident. If you are a foreigner, the maximum yearly contribution is $35,700. The amount must be contributed before December 31st for the Year of Assessment, in order to qualify for relief.

In addition to tax savings, we can use the money in our SRS to build our retirement funds by investing to Unit Trusts, Shares or Exchange Traded Funds (ETFs). We can also invest in selected Structure Deposits. For the risk averse, we can consider maximising our SRS funds by purchasing an endowment plan from insurance companies or simply depositing it with the bank as Time deposits.

TAX BENEFIT ILLUSTRATION

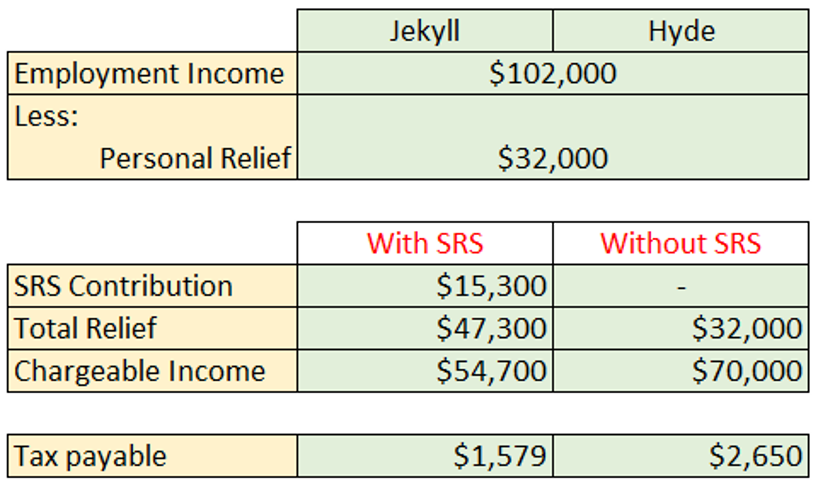

Below is a tax illustration of two Singaporean males – Jekyll and Hyde. Both are single, age 32, earning $6,800 a month and received 3 months bonus. Upon attending a webinar on SRS from Avallis Financial, Jekyll decided to contribute to his SRS Account but Hyde choose not to do it. Let us see the impact on the taxes between them.

Without SRS contribution, the chargeable income for Hyde will be $70,000 and he needs to pay an income tax of $2,650. By contributing to SRS, Jekyll will have a chargeable income of $54,700 and this will lower his tax bracket. His tax payable will be only $1,579. Assuming there is no change to the income and income tax structure for Jekyll and Hyde till their statutory retirement age of 63. The total tax saved over the next 31 years will be $33,201.

Does it mean there is no need for an SRS Account or contribution if we are not paying any income tax? It will be good to have one even if we are not paying any income tax now. We know that with longevity, our retirement age will be getting older and older. And as we age, our income will most likely increase and that means we might be paying income tax in the years to come. The good news is the statutory retirement age for SRS withdrawal is based on the date we make the first contribution. In 2019, the statutory retirement age was 62 and it was increased to 63 in 2022. The statutory retirement age will be 65 in 2030. What this means is even though we may not be paying any income tax now, we can still open an SRS account and contribute with just a dollar to “lock” our statutory retirement age of withdrawal at 63. There is no need to contribute to our SRS Account if we are not paying any income tax and we can start contributing when we need to pay our income tax in the future.