February 1, 2023

The sequence of returns refers to the order and magnitude of returns experienced by an investor over time.

The order and timing of investment returns can have a significant impact on the overall outcome of an investment portfolio. For example, if an investor experiences a negative return early in their investment timeline, it can have a greater impact on their portfolio value than a similar loss experienced later, due to the effects of compounding.

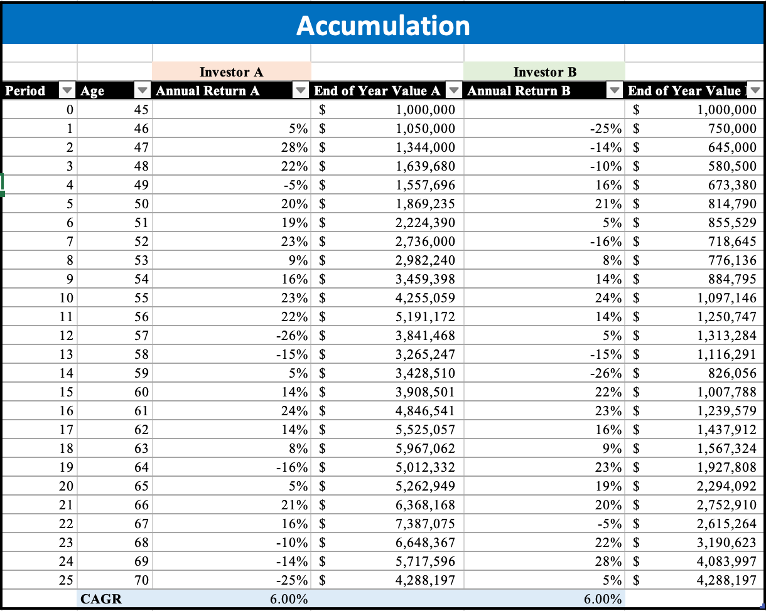

In the accumulation phase, the sequence of returns has little to no impact, provided the investor remains invested for the long term.

In the figure above, we flipped the sequence of returns for Investor B. The end values are the same. Both have an annual Compounded Annual Growth Rate (CAGR) of 6%. If Investor B gets out of the market at age 52 (after suffering losses for several years), then the sequence of returns risk impacts him during the accumulation phase. The familiar advice to “stay invested” holds true in this case. The longer you stay invested, the lesser the sequence of returns matters.

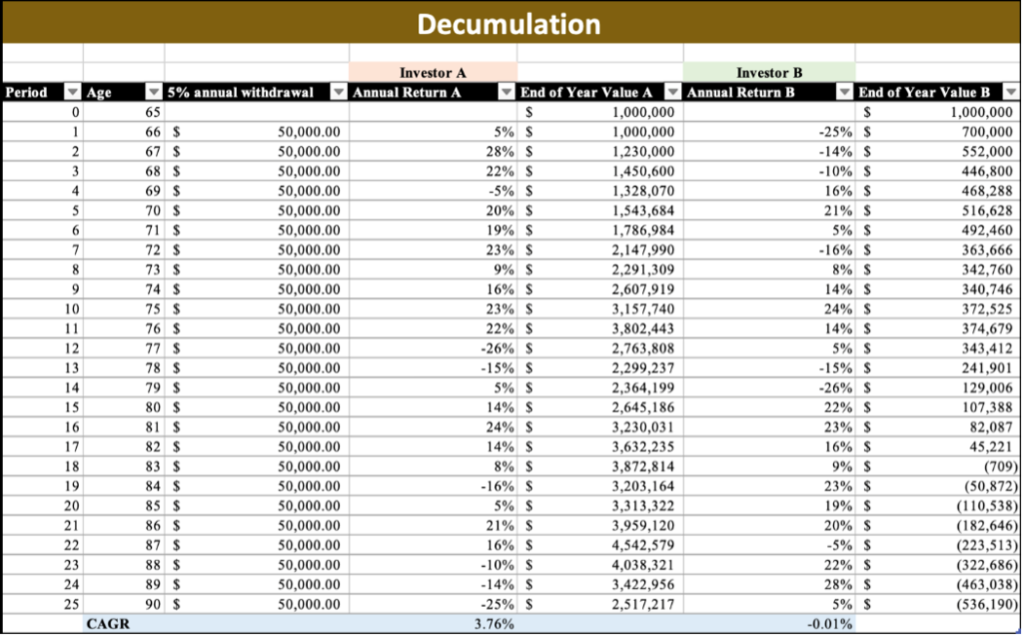

However, the sequence of return risk is particularly relevant for individuals relying on their portfolio for income during the decumulation phase. For example, let’s assume an investor remains invested beginning at age 65, withdrawing 5% annually from the initial amount. The sequence of returns has a significant impact this time round.

If the early years of decumulation begin with consecutive negative returns, the investor would see a rapid decline in his portfolio. If he begins withdrawing from his portfolio during a period of negative returns, his portfolio will be depleted more quickly, reducing the overall amount available for future expenses. In fact, he runs the risk of outliving his money.

As seen in the table above, Investor B would get nervous by the time he hits age 75. As for Investor A, he experienced positive returns in the early years and his portfolio continues to keep pace with inflation. He can afford to increase his withdrawal amount and still have a good balance at age 90. The table above does not account for lifestyle inflation.

Individuals need to understand this to make informed decisions about their retirement portfolio because it can have a significant impact on the overall sustainability of income in retirement.

To mitigate this risk, investors may consider using strategies such as diversification, using annuities or other forms of guaranteed income, or maintaining a different portfolio for withdrawal purpose.

In summary, when it comes to managing personal portfolios, one must be able to manage the transition from accumulation to the decumulation phase well, as it has a direct impact on the quality of his or her life and retirement. One would generally expect more certainty in the decumulation phase. It alleviates anxiety and worries in your later years. Employing the right decumulation strategy that aligns with your personal values and expectations is key.